Neighborhood Assistance Program (NAP) Credits

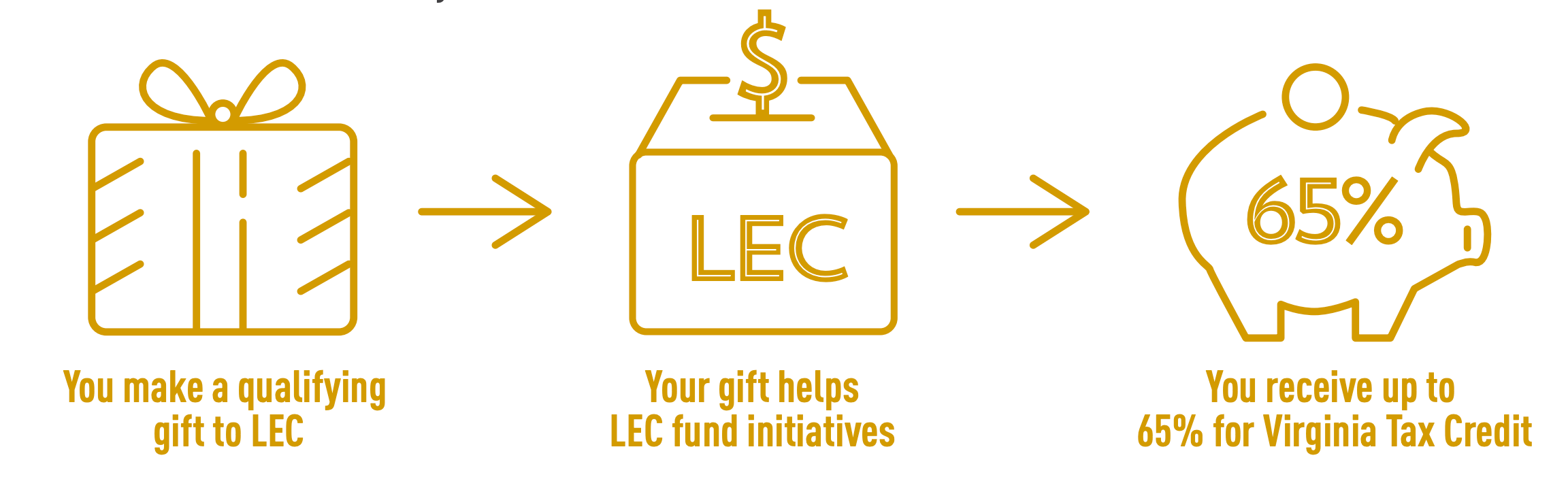

Receive 65% NAP State Tax CreditsThe Virginia Department of Education (VDOE) administers the Neighborhood Assistance Program allowing individuals and businesses to receive state tax credits for donations to approved nonprofit organizations that provide scholastic instruction or scholastic assistance to low–income persons or eligible students with a disability.

In return for their contributions, businesses, trusts and individuals may receive tax credits equal to 65 percent of the donation that may be applied against their state income tax liability.

APPLICATION INFORMATION

Approved NAP organizations and individuals are awarded allocations of tax credits for a 12-month period (July 1 – June 30). For more information regarding the Neighborhood Assistance Program and details about the criteria for becoming an approved NAP organization please visit Virginia Department of Social Services.

To receive the NAP Credit Application please contact:

Kevin Turpin

230 West Bute Street

Norfolk, Virginia 23510

757-623-6001